Imagine you’re walking alone at night along the moors. On a typical night, it would be so dark that you could not see the landscape, and getting lost would be inevitable; but, tonight, there’s a full moon out, and luckily the moonlight has enhanced your vision enough to reveal the werewolf standing next to you.

Yikes!

Like a full moon, financial planning can allow us to see things that we could not see before because we didn’t have the information – or the light – to see our own financial situation howling at us.

Why Is Personal Financial Planning Important?

Financial planning gives us the ability to really ask tough questions about our lives, like “Am I using my money in ways that will create more opportunities for me down the road?”, and “Will I have enough money for my retirement?”. When we honestly answer these kinds of questions, the answers help us figure out who we are, what’s important to us, and how we want our lives to look long term.

How you manage your money should be like breathing – it’s not something that requires too much thinking or effort, but you need to do it all the time.

What’s Financial Planning All About?

Financial planning isn’t always about just the money. At its core, financial planning is a way to create or maintain control of your life, not just your money. One of the main focuses of financial planning is being able to pursue whatever it is that’s most important to you.

Benefits of Personal Financial Planning

Your financial plan can have positive benefits to many aspects of your life. For example, potential emotional and health benefits that derive from having financial confidence.

Financial Planning for All Stages of Life

Financial planning helps to get you started while you work on your career and try to pay off debt and save for the future. And as you age, your financial life can have even more importance as time seemingly grows faster. A financial advisor professional can assist you to safeguard your family from unexpected circumstances that occur.

What Does a Financial Plan Look Like?

A financial plan is a financial planning worksheet that records your personal, professional and financial goals – the things you want to achieve in life – over a certain period of time. It’s also your road map or guide on how you can accomplish those goals. Most people start planning using an income statement, balance sheet, and cash flow statement. Most financial plans are built around these two areas: 1) Assets, and 2) Liabilities.

Family Financial Planning

Family financial planning is where individuals use the information gathered from all aspects of their lives to assess what they have, what they need, and how as a family they are going to go about getting it. It is common for people to use family financial planning as a life-stage guide for future plans, such as buying a house or raising children.

While these are aspects of family financial planning, they are not all inclusive. This means that there are many other areas that must be considered in order to potentially gain optimal benefit from this valuable tool.

How Might Taxes Have an Impact on Your Financial Plan?

Two of the objectives of tax planning is to increase assets and reduce (or mitigate) liabilities. When it comes to taxes, both federal and state income tax liability may be reduced by proper planning. Taxes affect your financial plan through the various tax rates that come into play in different regions of the economy.

Whether it be income, capital gains or property taxes, chances are your financial plan will be impacted by them in some form. It is important to know how they impact your current situation and in what ways you can reduce (or mitigate) liabilities.

Humanity Wealth Advisors and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

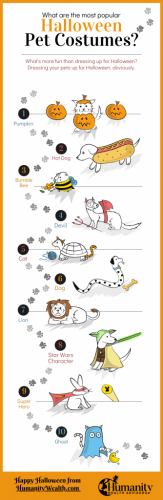

Pet Cemetery

As part of your estate plan, you can include your pet, even if it’s a “creature of the night”, to make sure your pet is taken care of in the event of something unfortunate happening to you or your pet.

Insurance varies with different companies and rates can vary based on where you live.

Establishing a pet trust in your will or living trust would ensure that when you pass away, the value of the assets transferred to the trust are ultimately distributed at some future date.

Before setting up any type of estate plan, it’s important to consult with an independent wealth advisor who can provide a perspective on your unique situation.

Are Financial Advisors Worth the Money?

A financial planner can be worth the money if taken into consideration that you would have to do all your financial planning and investing on your own. People who are uneducated in finance tend to not be the best at doing their own planning, but with the knowledge of investment portfolios and taxes, an independent financial advisor can put together a plan within your budget.

Talking with a financial planner isn’t necessarily expensive, and some fee-only advisors charge by the hour or have subscriptions available.

Saving Money vs Investing Money

Saving is the practice of preserving capital and purchasing power for future use. It involves effectively setting aside some amount of income one receives from earnings, commonly by depositing it into a savings account or other form of demand deposit such as a term deposit or certificate of deposit at a bank, credit union or brokerage firm.

Investing money can be better than saving money over time because of the power of compound interest and inflation. If you put your money into a financial instrument like a bond or equity, it can grow larger over time.

Assuming we want to experience the same purchasing power of $1 today in the future, (present value), but we factor in inflation. For example, if something costs $1 today, but one year from now that same thing now costs $1.10 – that’s inflation. It will take more of today’s money ($0.10 more) to buy the same thing a year from now.

So how do you get that extra $0.10?

Returns from investing are typically higher than just saving your money, meaning your money can be worth more and keep up with inflation versus just saving it under your mattress.

While it’s true that investing over time can help with inflation, all investing involves risk including loss of principal. No investment strategy ensures success or protects against loss.

In Conclusion

Financial planning isn’t scary. It doesn’t have to be a daunting task that you put off for another day, or even year. Financial plans don’t need to be complicated or time-consuming either. In fact, they can help with your budgeting and spending habits, manage debt effectively, protect yourself with insurance plans, and help you invest to build wealth over time.

A financial plan is just like any other kind of plan, but once everything is set up correctly it becomes much easier over time.

If this post helped clarify how easy creating a financial plan can be then please share it on social media! Let people know about these non-scary secrets today.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual nor do they necessarily reflect the views of LPL Financial.