Sadly, some people have to learn about managing their finances the hard way. Many millennials learn about using credit cards after they are thousands of dollars deep into debt. We don’t want that to be you!

If it is, and you want to get your finances under control, here are eight rules for millennials to apply starting today.

Use this guide from a financial advisor in San Ramon to help you navigate Financial Planning for Millennials.

Rule #1: Create a spending plan and budget

Creating a spending plan is the first step to setting some healthy financial boundaries. The importance of creating a budget cannot be overstated. The only way to ensure you’re on track financially is by monitoring your spending, sticking to your budget, and maintaining an eye on your net worth.

Tracking your spending means keeping tabs on it all—to stay aware. Once you figure out your “monthly burn rate,” make sure that number does not exceed a certain percentage, such as 50% or 25%. If it exceeds that threshold, look at where you could cut back.

Perhaps some things can be eliminated altogether, or some services can be switched from monthly subscriptions to annual payments. As an affordable financial advisor in the Bay Area, Humanity Wealth Advisors provides subscription-based financial planning to all ages, not just millennials! For $50 a month, this could be the best investment of the year.

Budgeting also includes tracking net worth (and income), so they match at any given time. This is important because it allows millennials that prefer immediate gratification with results to understand that efforts are paying off.

Rule #2: Set goals now

Set goals right now, not when you have money. Many wait until their financial situation is “better” to set goals. They say they’ll start saving or planning for retirement after getting a raise, after the holidays, or after their car is paid off, but there’s no reason to wait!

Set goals right now, not when you have money. Many wait until their financial situation is “better” to set goals. They say they’ll start saving or planning for retirement after getting a raise, after the holidays, or after their car is paid off, but there’s no reason to wait!

You can set milestones for yourself (like “I want to save $1,000 by the end of this month”) and build up from there. Even if you never reach those milestones, at least you will be getting into the habit of setting short-term and long-term goals.

Rule #3: Pay off your student loans

Student loans can be one of the most expensive debt burdens you’ll ever have, but many people don’t know exactly how much they owe until after graduation. Some may only be able to pay off their student loans in small amounts over time, which means that it can take years or even decades to get rid of them.

It’s important to understand that paying off student loans is not just about saving money—it’s also about building debt-free habits from the beginning and developing good credit scores so you can buy a house and start a family someday. The sooner you pay off your student loans; the less interest will accrue over time. This can give you an advantage over others who continue paying high rates on their education debts well into middle age or beyond.

Rule #4: Pay down credit card debt

The fourth golden rule of finance is to pay off your credit card debt and try not to accumulate more.

While it’s true that having a revolving line of credit can be helpful in an emergency, the sad reality is that most people use their credit cards to spend money they don’t have. This strategy is bad for multiple reasons:

- You’ll pay interest on purchases you could’ve made with cash, making it expensive to shop.

- If you miss payments, this will hurt your credit score and cost even more money in fees and penalties.

The best way to avoid these problems is simple: Don’t use them! Cash or debit cards are acceptable for everyday expenses. Still, if you’re going out for dinner or buying something expensive, it’s usually better to save up until you can afford the purchase outright—then buy with cash instead of charging it on your card.

Rule #5: Save and invest early for retirement

The sooner you start investing, the better your odds of having enough money when it comes time to retire. Even if you haven’t saved much yet, that’s not an excuse not to begin. Investing just $100 monthly in mutual funds can make a massive difference over time.

Even if you don’t have much to invest right now, start putting it away every month and don’t touch it. You’ll be glad later on that you did. The power of compounding interest is real!

If your employer offers a 401(k) or other workplace retirement plan, contribute as much as possible upfront. Make sure that the amount gets deducted automatically from each paycheck.

Rule #6: Have an emergency fund of three to six months of living expenses

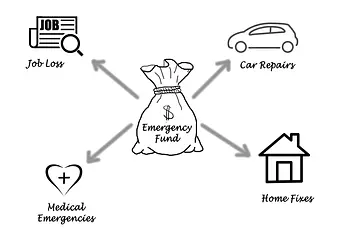

An emergency fund is a lump sum of money you keep on hand for unexpected situations. You may need it to cover a medical bill or car repair or to replace income if you’re temporarily out of work due to illness or injury.

An emergency fund is a lump sum of money you keep on hand for unexpected situations. You may need it to cover a medical bill or car repair or to replace income if you’re temporarily out of work due to illness or injury.

The goal of having an emergency fund is twofold:

-

-

-

- It gives you some financial flexibility during uncertain times.

-

-

- It can provide financial confidence in knowing that the basics are covered.

As wealth management financial advisors in San Ramon and Newark, we recommend saving three to six months of living expenses in case something unexpected happens. You can do this by setting aside any extra money each month, or applying gifted money to it, such as birthday money or tax return funds saved.

Rule #7: Don’t spend all your money on unnecessary things

If you are just getting started with financial planning in San Ramon, this is a big one! The next financial planning rule for millennials is not to spend all your money on unnecessary items.

This seems like common sense, but many people falter big time in this area. Don’t splurge on things that aren’t important to you and that don’t provide value in return.

Rule #8: Diversify your investments

Diversification is the practice of spreading your money across many different sectors. It can help you work toward your goals and potentially reduce risk. There are many types of investments to choose from, including:

- Real estate

- Bonds (debt)

- Mutual funds (mutual ownership in a group of companies)

- Individual stocks (ownership in a single company)

Work with Humanity to manage your finances more effectively using these rules

A good plan is like a road map for your finances that can help as you work toward your goals. It’s a set of rules you follow to help manage your finances more effectively and achieve what you want out of life.

At Humanity Wealth Advisors, we have a subscription model that can help you get started on the right path if you have been procrastinating in getting personal finance support. We are here to level the financial playing field within comprehensive financial planning.

Because you will want different financial guidance along your journey, you tell us what you need and when. Now that you know some of the basic rules to follow in order to better manage your money reach out to conquer your financial obstacles. It’s time to realign with a plan that matches your goals.