It pays for every generation to understand that tax law change is common. Learning to embrace it and use it to your advantage is where we step in. Since tax education is not included in your educational repertoire (and there is no shame in this), taxpayers must learn by choice or by chance.

And there’s a good chance that reaching out to affordable financial planning in the Bay area will be your wisest choice yet.

May I remind you? “Knowledge is power.”

Please understand that this article is not intended to give tax advice. I simply invite you to empower yourself with current and tentative tax knowledge. Of course, our services take financial planning much further; it helps to know that IRS inflation adjustments will always be in play; tax-year 2022 is no different. Several impending tax law changes are on the horizon and worth noting.

Humanity Wealth offers affordable bite-size financial guidance for every budget! Invest in your future by getting professional advice, YOUR WAY.

Key Tax Law Changes In 2022

Several pieces of legislation have been picking up steam. Below are a few highlights that may assist in your new investment strategy.

Build Back Better (BBB) Act

Some of the key provisions (1) associated with the BBB Act include Backdoor Roth Conversions, Megabackdoor Roth Conversions, and Roth Conversions for Higher-Income Earners.

Essentially, this bill could limit taxpayers and, most specifically, high-income earners from putting more of their retirement savings into the “Roth Bucket.” This means less tax-free money in retirement.

The Securing A Strong Retirement Act of 2021 (Secure 2.0)

The Secure 2.0 is more likely to pass with most of its key provisions intact when compared to BBB Act.

In summary, the more impactful changes (2) would focus on:

- Increasing the RMD age

- Indexing the IRA catch-up contributions

- Increasing catch-up contribution limits for 401(k)s and other employer plans

- Improving SEP IRAs and SIMPLE IRAs by allowing Roth provisions

Why Each Generation Needs To Know About The Potential Tax Law Changes In 2022

Up and coming high-income earners are advised to understand the potential tax law changes that could impact your ability to put more funds into the “Roth Bucket.”

If these strategies are disrupted, planning for retirement and, more specifically, where to save (and which types of accounts) will be more critical. It may be challenging to find tax diversification across account registrations.

If you’re preparing for retirement, diverse provisions may help you put more money into retirement accounts and even aid in early retirement. Again, a certified financial planner in conjunction with your tax professional can help you determine what is feasible.

The Required Minimum Distributions (RMD) age was increased to 72, so there may be more years to use Roth Conversions. However, it may be more challenging to execute on Roth Conversions if legislation is passed.

IRS Issued Inflation Adjustments For Tax-Year 2022

The IRS makes annual changes to several income thresholds, tax rate schedules, and contribution limits. These updates are based on annual adjustments due to inflation.

The following are updates for the Tax-Year 2022, which will impact your 2023 tax return. If these charts overwhelm you, please contact your tax professional for advice.

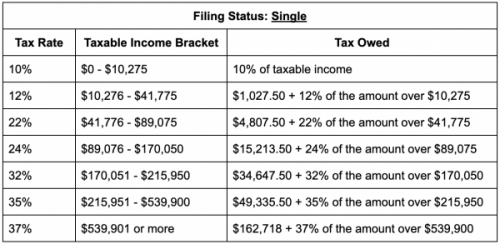

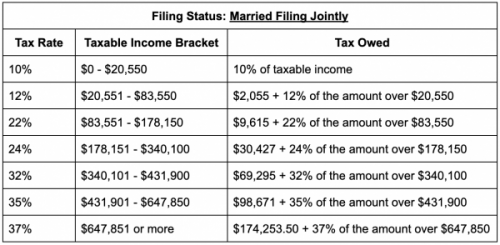

Tax Brackets and Tax Rates

For Tax-Year 2022, the IRS increased the income thresholds specific to each of the seven federal tax brackets. While there are many different ways to file, here are updates for single and married filers. Source: IRS Revenue Procedure 2021-45.

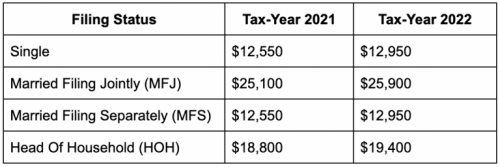

Standard Deduction

Most taxpayers take the standard deduction (reduces your taxable income) instead of itemizing.

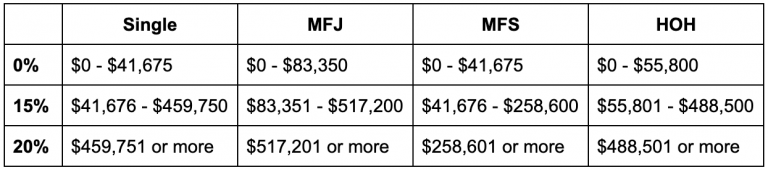

Capital Gains Tax Rates

Capital gains taxes are a result of realizing profits after selling an asset. For example, you may have to pay capital gains tax if you sold a stock for more than you paid.

- Short-Term Gain: Realized gain on an asset held for less than 1-year

- Long-Term Gain: Realized gain on an asset held for longer than 1-year + one day

When you realize short-term capital gains, you are taxed at your ordinary-income tax rate. However, the IRS allows for more favorable tax treatment if your realized gains are considered long-term. Below are the updated numbers for the Tax-Year 2022 Capital Gains Tax Rates:

Retirement Plan Contribution and Income Limits

There are the certain contribution and income limits to be aware of when saving for retirement.

If your employer offers you a 401(k), you can now contribute up to $20,500 (as an employee deferral). In 2021, that contribution limit was $19,500. In addition, if you are over the age of 50 in the tax year of 2022, you can contribute an additional $6,500 as an employee deferral – allowing for a total employee deferral contribution limit of $27,000.

For Traditional IRAs and Roth IRAs, the contribution limit amount for tax-year 2022 is still the same as the tax year 2021:

- Under age 50: $6,000

- Over age 50: $7,000

However, the IRS did update the income limits associated with (1) being able to receive a deduction from Traditional IRAs and (2) being able to contribute to a Roth IRA simply.

- IRA Contribution & Deduction Limits (NOT COVERED) for 2022

- IRA Contribution & Deduction Limits (ARE COVERED) for 2022

- Amount of Roth IRA Contributions That You Can Make for 2022

Health Savings Account (HSA) Contribution Limits

If your employer offers you a High-Deductible Health Plan, you likely also have the benefit of utilizing a Health Savings Account (HSA). These types of accounts allow for tax-deferred growth and potentially tax-free withdrawals for future medical expenses in retirement. When planning for retirement, these are highly beneficial tax-advantaged investment accounts to supplement employer plans (like a 401(k)), IRAs, and taxable brokerage accounts.

The HSA contribution limits for tax-year 2022 have increased to $3,650 for “self-only” (from $3,600 in 2021) and $7,300 for “family plans” (from $7,200 in 2021).

For the inflation updates on contributions into retirement plan accounts, HSAs, and IRAs, ask about increasing contributions. Don’t miss out on what the IRS allows you to contribute to your plans.

It’s Never Too Early or Too Late to Start Financial Planning! Reach out today and get started.

Humanity Can Help!

At Humanity Wealth, our wealth advisors truly believe that tax planning plays an important part in your holistic financial health.

Schedule an introductory call here to learn how we can help!

Humanity Wealth Advisors and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

References/Citations